Manhattan, at the heart of the vibrant state of New York, proudly holds the title of the world’s leading financial hub. It is also the third most visited tourist destination in the United States, and its sales and rental prices continue to rise resiliently, even through every imaginable crisis.

However, not everything is a honey moon for the residents of the Big Apple.

As prices continue to rise, many residents are pushed to relocate to nearby cities — such as Brooklyn or Queens within New York State, or Hoboken, West New York, and Jersey City across the river in New Jersey — in search of more affordable rents without sacrificing access to Manhattan’s job market.

This shift naturally raises two key questions for anyone considering real estate investment in this part of the East Coast:

Why choose Jersey City?

And what lessons from this market can be applied to other cities?

1. Strong Connectivity

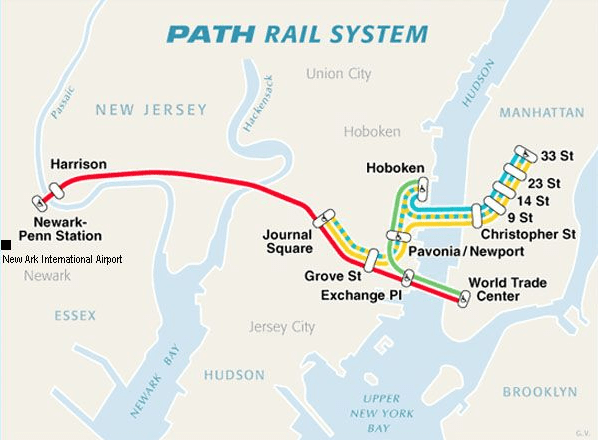

First and foremost, the level of connectivity between Manhattan (New York) and Jersey City (New Jersey) ensures that distance is not a real barrier. The region is served by well-established transit systems such as the PATH (the interstate subway linking Manhattan, Hoboken, and Jersey City), as well as a network of buses and ferries that cross the Hudson River.

Using the PATH, the ride from Penn Station — the last stop in Manhattan — to Journal Square — the last stop in Jersey City — takes an average of just 25 minutes. And traveling from Manhattan’s Financial District (Wall Street) to Jersey City’s financial hub (Newport) takes around 10 minutes. In other words, commuting to Jersey City can take roughly the same time as traveling from Wall Street to Harlem, or to many neighborhoods in Brooklyn or Queens.

2. Emerging market

Secondly, we are looking at a market that is still emerging, with strong growth potential, ongoing gentrification, and large industrial areas that are expected to transition into residential use in the medium term.

A clear indicator of this momentum is the presence of major real estate investors such as Kushner, Iron Mountain, Silverstein, Ironstate, and the Manchanda Group, among others.

The following link provides access to an interactive map showcasing nearly all of the real estate projects currently under development or construction in Jersey City — and many more are on the way.

3. City Support

Equally important are the ongoing efforts from the Planning and Construction Departments to digitize permitting and inspection procedures (goodbye to unnecessary paper use), streamline cadastral inquiries, increase public access to information, and facilitate virtual public meetings, among other improvements.

In addition, the city operates under Urban Development Plans (such as the Journal Square 2060 Plan) which are continuously monitored and updated in coordination with neighborhood representatives. The goal is to establish clear rules from the outset and, if a developer requests changes, ensure those proposals are reviewed transparently through public hearings.

These initiatives have positioned Jersey City as a leading municipality in both digital transformation and public governance — reducing time and costs for investors while actively involving residents in the decision-making process.

- Zoning Map (includes links to regulations and approved urban development plans)

- Property Records (statewide database for New Jersey)

- Online permitting and inspection system (no more paper waste 💚)

- Open Data Portal (up-to-date information on city management; you can even view architectural projects, as I explained in this post)

4. Privileged Views

Manhattan is spectacular from any angle, but the panoramic skyline you get from across the Hudson River is truly unmatched. You’re not in Manhattan — you’re enjoying it from the VIP seats, with the whole skyline right in front of you.

But don’t get me wrong! Jersey City has a charm of its own.

Now, some might argue that Brooklyn or Queens are just as close to Manhattan, and that they also offer beautiful buildings, parks, and great amenities. However, there is one factor that — at least for now — tips the balance in favor of Jersey City: the cost of living.

5. Cost of Living

According to the most recent data available, average rental prices in Jersey City remain lower than in Manhattan and Brooklyn, although costs can vary depending on the neighborhood and the type of property. For example:

- In Jersey City, the average monthly rent for a one-bedroom apartment is around $2,200, and for a two-bedroom unit approximately $2,800.

- In Manhattan, a one-bedroom apartment averages around $3,500 per month, while a two-bedroom typically reaches about $4,500.

- In Brooklyn, a one-bedroom averages roughly $2,800 per month, and a two-bedroom about $3,600.

Note: These figures reflect comparable properties in terms of finishes and building amenities. Rents in Manhattan can be considerably higher depending on the location and level of exclusivity.

6. What about the construction cost?

When it comes to average construction costs per square foot, the final price can vary depending on numerous factors, such as location, project scale, building type, and selected materials. However, for a mid-rise new development, the estimates are roughly as follows:

- In Jersey City, average construction costs range from approximately $300 to $400 per square foot.

- In Brooklyn, they typically range from $400 to $500 per square foot.

- In Manhattan, under similar standards, costs can rise to approximately $600 to $700 per square foot.

Conclusions

Jersey City has emerged as an attractive destination for real estate investment due to the following conditions:

- Strategic proximity and easy access to a vibrant global hub like New York City, whose leadership as both a tourism and financial center benefits its neighboring districts.

- An emerging market profile, with consolidated residential and commercial zones alongside underutilized areas with strong development potential.

- Well-defined urban planning frameworks, which remain open to targeted updates through participatory processes with local communities.

- Strong institutional support, with state and municipal agencies providing digital tools that streamline procedures and ensure transparency for both investors and the general public.

- More accessible land values, paired with mid-to-high rental yield expectations, comparatively lower construction costs, and very low vacancy rates (around 5% annually).

Of course, any process of gentrification comes with its own social and economic challenges — but that will be a topic for another post.

Do you know of other cities with a similar dynamic to Manhattan vs. Jersey City? What investment opportunities would you highlight in those markets?

(Photo by Bruce Emmerling on Pixabay, edited by the author)

Leave a comment