Everything in life has a price, but it also has a value. Are they the same? Not quite. And be careful — the difference between the listing price and the true market value of a property can amount to thousands of dollars. So it’s worth taking seriously.

We could sum it up in one simple equation:

Price = Value ± Profit or Loss

In other words, valuation gives us an idea of what a property represents today.

Note: The announcement of a new celebrity moving into the neighborhood, the opening of a shopping center, upcoming renovations, or the construction of new transit routes can quickly raise expectations about a property’s value — and, as a result, its price — sometimes within days. Stay alert to these shifts.

If you want to learn the art of property valuation in the United States—whether you’re interested in real estate brokerage, appraisals, development, construction, or just curious about how value is created—this article is for you.

While the most accurate way to determine a property’s value is by hiring a certified appraiser, there are several free online tools that can give you a fairly close estimate.

Below, I’ll show you the five most popular free websites in the United States for property valuation—perfect for getting a solid starting point 😉

Keep in mind that these are automated valuations based on recent data such as neighborhood trends, square footage, materials, number of rooms, and comparable sales in the area. They do not reflect what the market might be willing to pay in the future, or what the owner believes the property is worth.

That being said, I’ll use a random address in the state of Tennessee:

724 Tahlena Ave, Madison, TN 37115

Let’s get started.

1. Zillow

Here you can find almost all the information you need. We can see that this property is listed for $749,900, but under the “Home Value” tab, the estimated market value is $710,200, with a potential selling range of up to $746,000.

Keep this number in mind: $710,200

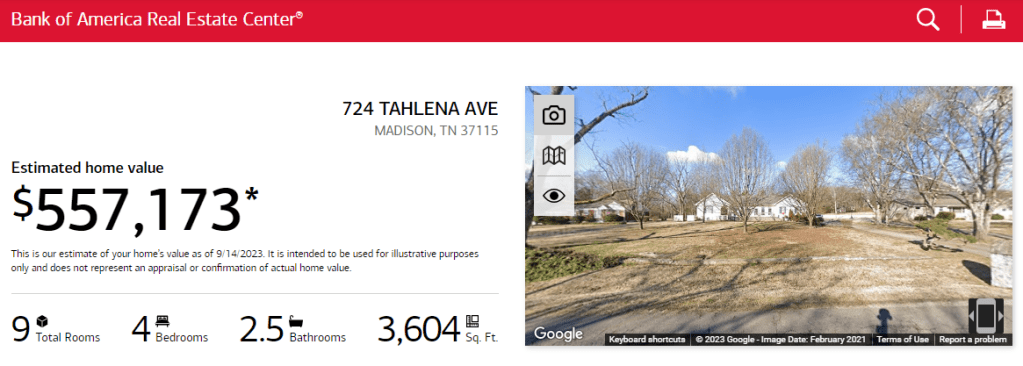

2. Bank of America

https://homevaluerealestatecenter.bankofamerica.com/

According to this website, the home estimated value is: $557,173

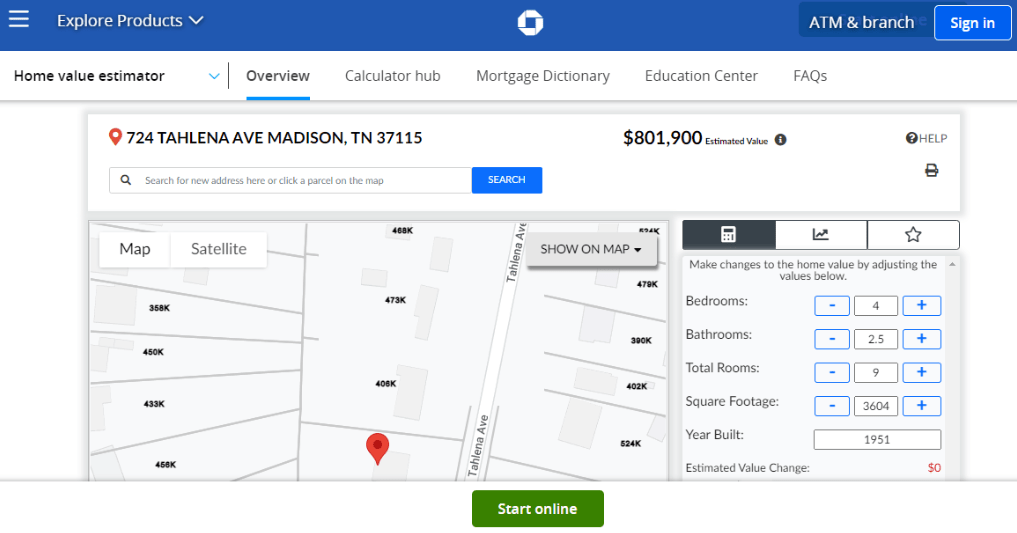

3. Chase

https://www.chase.com/personal/mortgage/calculators-resources/home-value-estimator

Chase Bank shows a value of: $801,900

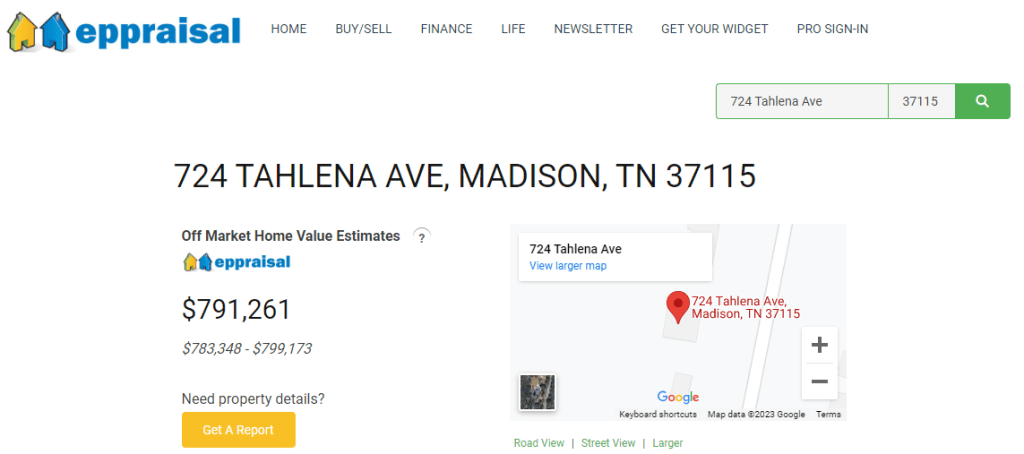

4. Eppraisal

Here the home value is: $791,261

Note: Be careful when typing the address into the search bar — it’s split into two fields: one for the address and another for the ZIP code.

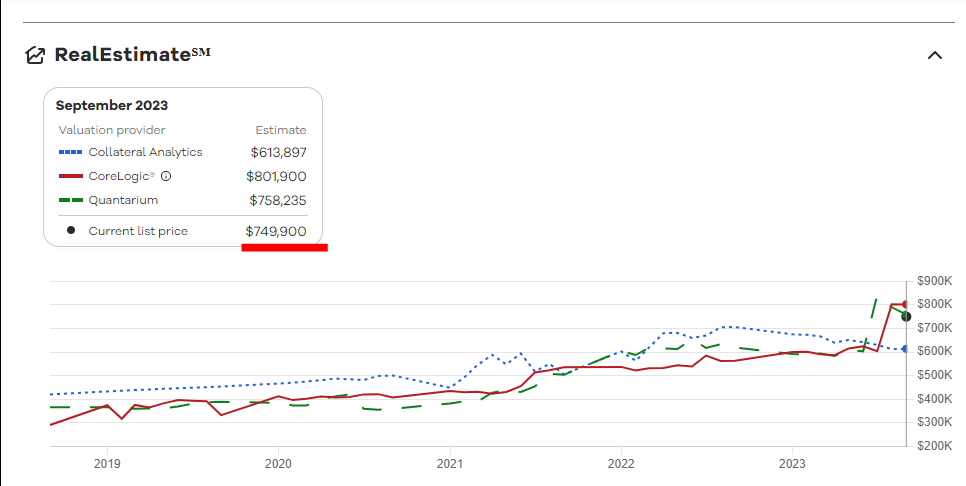

5. Realtor

Lastly, Realtor.com comes with a market value of: $749,900

To see this value, simply click on the “RealEstimate” tab. It’s quite interesting — the platform shows how the price has evolved based on data from three independent valuation models, averaged together..

Conclusions

You might be wondering why these five websites show different values for the same property. It’s a fair question — and the short answer is that each one uses its own software and database to calculate estimates.

Even though all of them are reliable, some use information that others simply don’t take into account. That’s why many investors prefer to check several sources at once — to get a broader view of what’s happening in the market and average the results if needed (except, of course, in those cases where there are obvious errors — nothing’s perfect in this life).

To summarize, we have:

- Zillow: $710,200

- Bank of America: $557,173

- Chase: $801,900

- Eppraisal: $ 791,261

- Realtor: $749,900

Average: $722,087

This means that while the property is listed for $749,900, its real market value could be closer to $722,087.

That would be a good starting point for negotiation. Depending on whether you’re a buyer or a seller, the next step is to define your strategy.

If you’re a homeowner looking to sell, how much profit are you hoping to make? Have you considered working with a real estate agent? What’s the average time on the market in your neighborhood? How soon would you like to close the deal?

And if you’re a buyer, what’s the average selling price in the area? Is this property really worth buying today? What additional monthly expenses should you factor in before committing to a mortgage?

I’ll be diving into all of these topics in future posts.

Thanks for reading!

Leave a comment